texas estate tax law

Senate Bill 1 increases the existing mandatory homestead exemption on. Texas Probate Guide.

Petrosewicz Law Firm P C Facebook

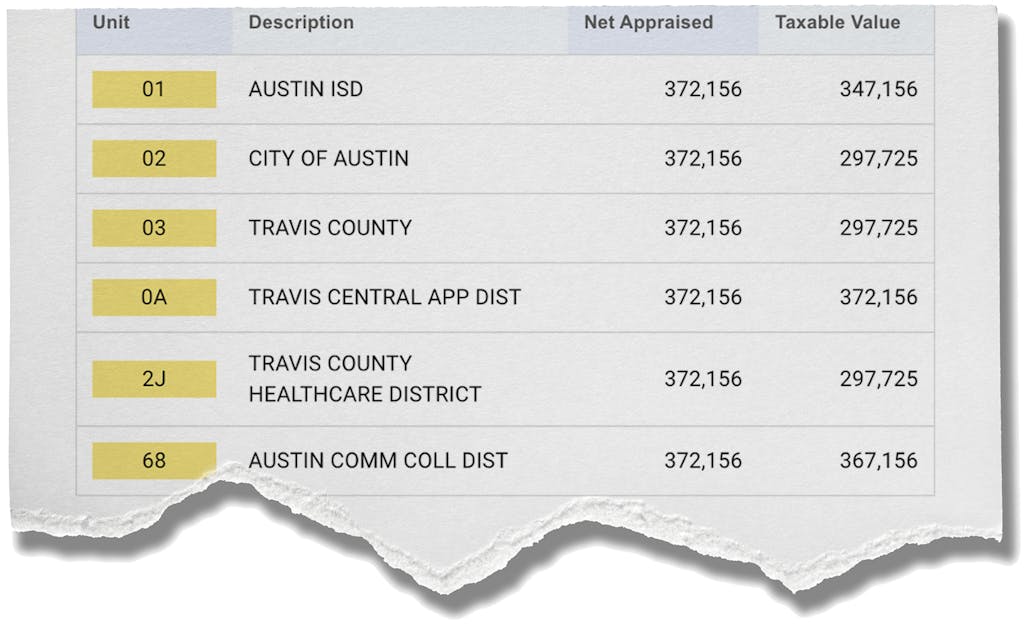

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services.

. Ptadcpacpatexasgov or 800-252-9121 or write to us at Texas Comptroller of Public Accounts Property Tax Assistance Division PO. A If a person who dies intestate. Texas Property Tax Law Changes 2021 1 Tax Code Chapter 5.

Federal state and local governments all collect taxes in a variety of ways. Finally the new Texas property tax law is the most significant change coming in 2022. To access first get a free library account online with the Texas State Law Library.

Many of these e-books contain legal forms or drafting guides. The Texas Tax Code sets forth how all taxes in Texas should be levied and against what party or property on which the tax should be levied. Houston is the exception where the limit has been 4 percent.

State revenues are comprised of property taxes sales tax and certain taxes on businesses. Senate Bill 1449 amends the Tax Code to increase the taxable value threshold below which incomeproducing tangible personal property held is entitled to a property tax. The Property Tax Assistance Division provides a Handbook of Texas Property Tax Rules PDFFor up-to-date versions of rules please see the Texas Administrative Code.

Conduct of the Property Value Study a Definitions. Handbook of Texas Property Tax Rules 1 Texas Property Tax SUBCHAPTER A. Relationships between landlords and tenants.

Reduction to the Estate Tax Exemption. Property and real estate law includes homestead protection from creditors. Visit a law library near you to.

Now if there is a proposed property tax hike that exceeds 35 or 25 percent the measure will automatically be added to. ESTATE OF AN INTESTATE NOT LEAVING SPOUSE. This law will drastically alter how property taxes are calculated in.

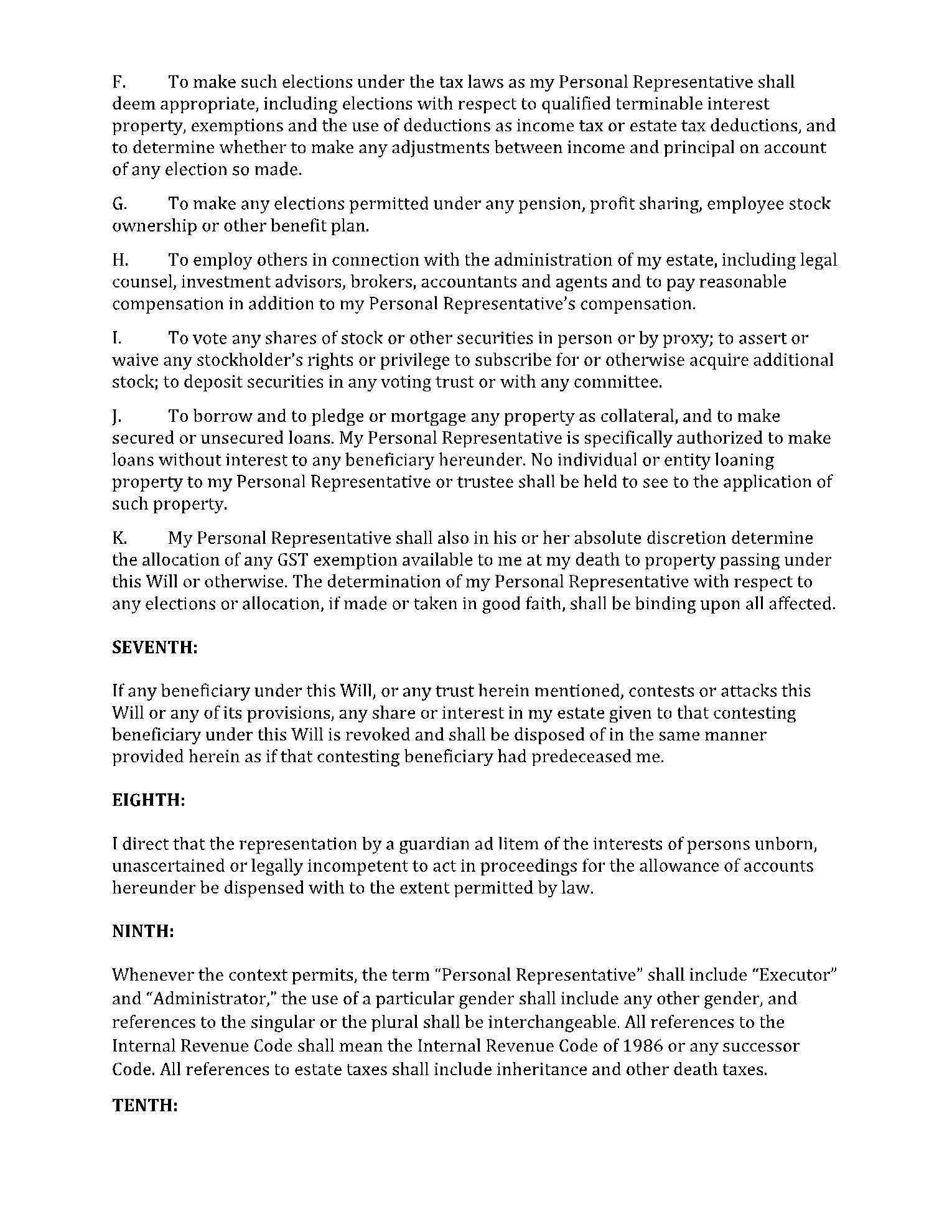

There is a 40 percent federal tax however on estates over. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Home Sales Tax Exemptions.

PRACTICE AND PROCEDURE 9101. State Administration Section 503 SB 63 and HB 3786 add subsection d allowing the Comp-troller after giving notice to. The following are some of the property tax law changes from the Texas 87th Legislative Session.

This article authored by Forbes Forbes Law includes an infographic that breaks down the probate process into eight easy-to-understand steps. And other matters pertaining to ones home or residence. Box 13528 Austin Texas 78711-3528.

Home sales are taxable up to 20 under the Texas Tax Law so if you sold your home for 250000 you owe 50000 in taxes. 1 Aggregate tax rate means the combined tax rates of all relevant taxing units authorized by law to levy property taxes against a dealers vessel and outboard motor inventory. Property Tax Law.

In the instance of mineral estate taxation however. In the past year there were proposals to reduce the estate tax exemptionmeaning lowering the amount after which individuals will.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Living Will Form Free Download Cocosign

Richardson Tx Estate Planning Law Firm Estate Tax Federal Tax

Texas Inheritance Laws What You Should Know Smartasset

Three Things I Learned From My Estate Planning Lawyer You Must Do

Does Property Passed By Transfer Receive A Step Up In Basis

State Estate And Inheritance Taxes Itep

Talking Taxes Estate Tax Texas Agriculture Law

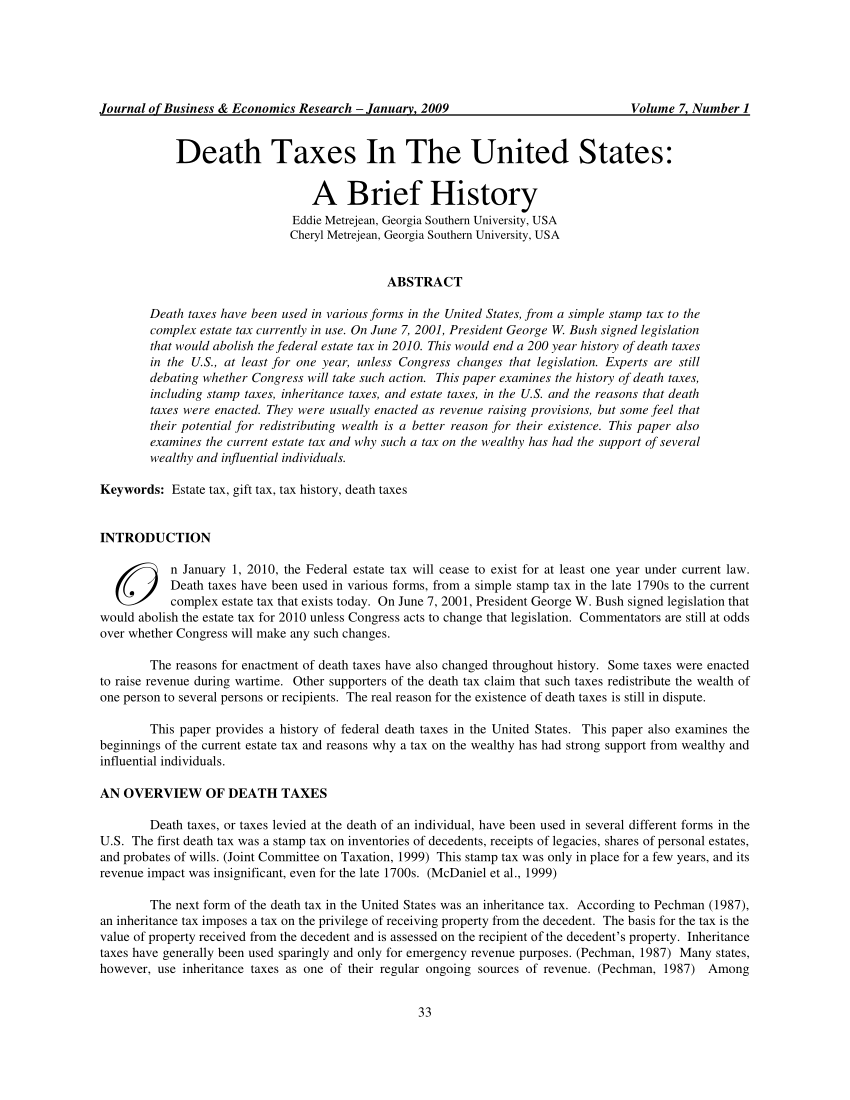

Pdf Death Taxes In The United States A Brief History

Affidavit Of Heirship For A House Texas Property Deeds

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Estate Gift Tax Law San Antonio Texas

Death Tax In Texas Estate Inheritance Tax Law In Tx

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Richardson Tx Estate Planning Law Firm Estate Tax Federal Tax

What The Bleep Is Going On With Texas Property Taxes Texas Monthly